Background

Eurobank, the most customer-centric bank and one of the four systemic banks in Greece, was in search of technology solutions that would enable the implementation of its strategic plan, “Eurobank 2030”, which would allow for the introduction of the Bank’s new “future branches”. This new concept would introduce a new model to the Greek market by investing in Human-Technology-Sustainability, through a combination of cutting-edge technology and the expertise of its staff, supporting the Bank’s effort to achieve sustainable and inclusive growth.

The challenges

Self-Service Terminals play an essential role in the Bank’s operations in the Greek market, as cash remains a popular payment method across the country. On one hand, this maintains the pressure on financial institutions to:

- manage availability and customer service,

- unproductive tasks: maintaining aged bill payment machines, improving terminal malfunctions, upgrading old software and operating cash supplies in every branch.

On the other hand, firm attachment to cash is a somewhat double-edged sword, since withdrawing and depositing cash from ATMs is one of the most common ways customers interact with banks. But that customer interaction comes with its challenges, including the costs of keeping cash in circulation and a slower return on investment (ROI) for banks.

The solution

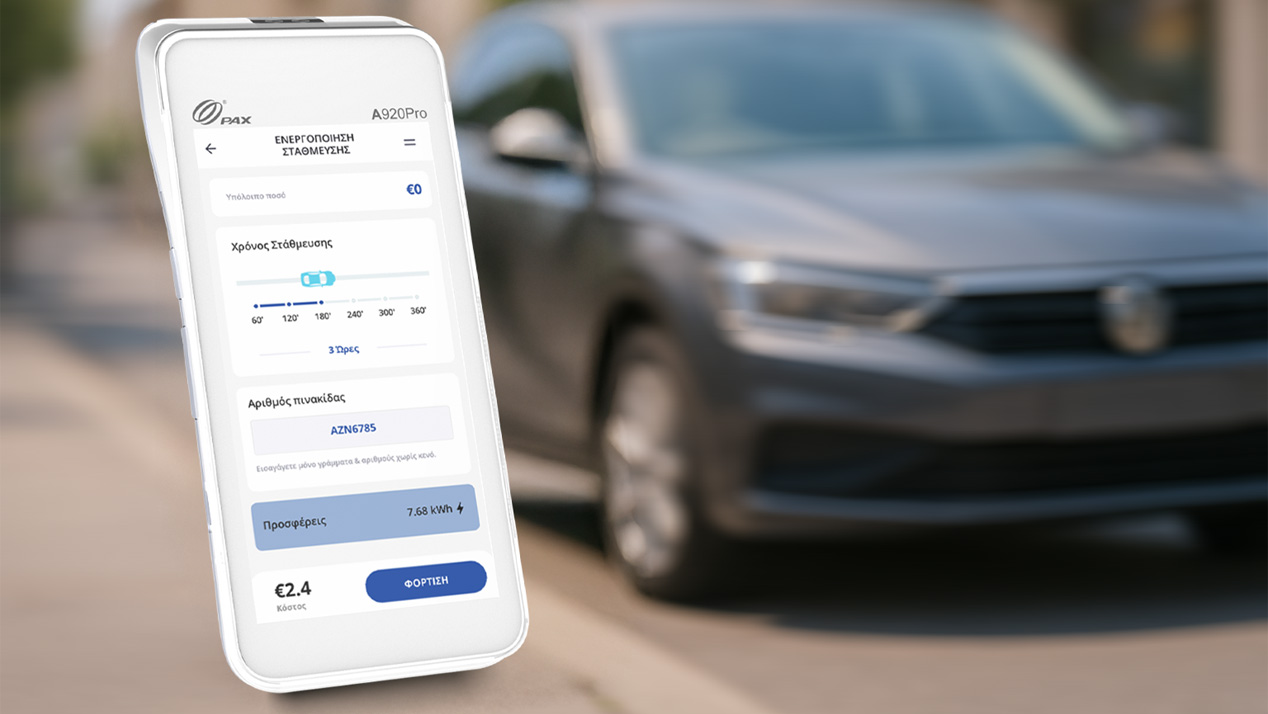

The Bank has selected cash recyclers as a holistic solution that will help meet its goals of:

- branch transformation,

- improved customer satisfaction,

- reducing costs,

- increasing the digital dialogue between the customers and the new machines,

- driving efficiencies,

- moving forward towards branch digitization and automation projects.

After carefully evaluating transaction types and volumes occurring throughout their branch network, Eurobank realized they could gain valuable efficiencies by switching to next-gen automated bill payment machines. The new GRGBanking cash recycling solution has been deployed and launched, leveraging an intelligent finance technology and innovative solutions to enhance the efficiency of business operations, reduce costs, and deliver customer satisfaction.

The benefits

Until end of 2022, 450 new generation cash recycling machines by GRGBanking, were deployed in the whole branch network of Eurobank in Greece.

The immediate benefits of the new cash recycling solution have been clear.

- Faster transaction times

- Greater convenience

- Enhanced customer experience

- Improved customer acquisition, conversion, and retention rates

- Reduced total cost of ownership (TCO)

- Enhanced protection against fraud attacks

- Promotion of digital dialogue with customers

- Evolving branch layout through relocation of customers from tellers to Self-Service machines

[Customer quote- to be placed on a separate frame]

“We like the design, the features, and the quality very much. Our machines have recorded some of the highest transaction volumes in the country. It totally changes the way we serve our customers— and what we can do for them. We are planning to expand our Self-Service network still further and add even more innovative services to help our customers even more. We believe this reflects the customer expectation at Eurobank, and it is a positive endorsement of business strategy.”

Panagiotis Kotsis, Self-Service Banking Terminals Director.

Background

Eurobank, the most customer-centric bank and one of the four systemic banks in Greece, was in search of technology solutions that would enable the implementation of its strategic plan, “Eurobank 2030”, which would allow for the introduction of the Bank’s new “future branches”. This new concept would introduce a new model to the Greek market by investing in Human-Technology-Sustainability, through a combination of cutting-edge technology and the expertise of its staff, supporting the Bank’s effort to achieve sustainable and inclusive growth.

The challenges

Self-Service Terminals play an essential role in the Bank’s operations in the Greek market, as cash remains a popular payment method across the country. On one hand, this maintains the pressure on financial institutions to:

- manage availability and customer service,

- unproductive tasks: maintaining aged bill payment machines, improving terminal malfunctions, upgrading old software and operating cash supplies in every branch.

On the other hand, firm attachment to cash is a somewhat double-edged sword, since withdrawing and depositing cash from ATMs is one of the most common ways customers interact with banks. But that customer interaction comes with its challenges, including the costs of keeping cash in circulation and a slower return on investment (ROI) for banks.

The solution

The Bank has selected cash recyclers as a holistic solution that will help meet its goals of:

- branch transformation,

- improved customer satisfaction,

- reducing costs,

- increasing the digital dialogue between the customers and the new machines,

- driving efficiencies,

- moving forward towards branch digitization and automation projects.

After carefully evaluating transaction types and volumes occurring throughout their branch network, Eurobank realized they could gain valuable efficiencies by switching to next-gen automated bill payment machines. The new GRGBanking cash recycling solution has been deployed and launched, leveraging an intelligent finance technology and innovative solutions to enhance the efficiency of business operations, reduce costs, and deliver customer satisfaction.

The benefits

Until end of 2022, 450 new generation cash recycling machines by GRGBanking, were deployed in the whole branch network of Eurobank in Greece.

The immediate benefits of the new cash recycling solution have been clear.

- Faster transaction times

- Greater convenience

- Enhanced customer experience

- Improved customer acquisition, conversion, and retention rates

- Reduced total cost of ownership (TCO)

- Enhanced protection against fraud attacks

- Promotion of digital dialogue with customers

- Evolving branch layout through relocation of customers from tellers to Self-Service machines

[Customer quote- to be placed on a separate frame]

“We like the design, the features, and the quality very much. Our machines have recorded some of the highest transaction volumes in the country. It totally changes the way we serve our customers— and what we can do for them. We are planning to expand our Self-Service network still further and add even more innovative services to help our customers even more. We believe this reflects the customer expectation at Eurobank, and it is a positive endorsement of business strategy.”

Panagiotis Kotsis, Self-Service Banking Terminals Director.